Unlocking Business Potential: The BCG Matrix Explained

In the dynamic world of business, strategic decision-making is essential for growth and sustainability. Enter the BCG Matrix, a powerful tool developed by the Boston Consulting Group in the 1970s that helps organizations analyze their product portfolios and allocate resources effectively. But what exactly is the BCG Matrix, and why should you care? Let’s dive into this strategic framework and uncover its insights!

What is the BCG Matrix?

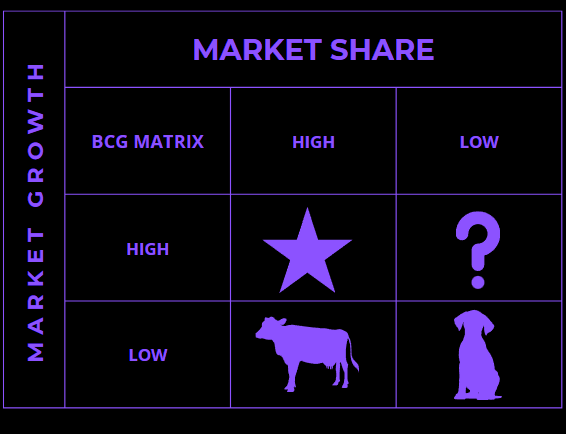

The BCG Matrix, also known as the Growth-Share Matrix, is a graphical representation that categorizes a company’s products or business units based on two key dimensions: market growth and market share. It classifies products into four quadrants:

- Stars: High growth, high market share

- Cash Cows: Low growth, high market share

- Question Marks: High growth, low market share

- Dogs: Low growth, low market share

Each quadrant provides insights into the appropriate strategies for each product or unit, guiding businesses in maximizing their overall portfolio performance.

The Quadrants Explained

1. Stars: The Brightest Lights in the Portfolio

Stars are products that enjoy a strong market presence in a rapidly growing industry. They require significant investment to maintain their position and support growth. These are the products that are currently generating substantial revenue, and with the right resources, they can become the future Cash Cows.

Strategy: Invest heavily to capitalize on growth opportunities. Nurture these products to ensure they maintain their leading position.

2. Cash Cows: The Stable Income Generators

Cash Cows are products with a high market share in a mature, slow-growing industry. They generate more cash than they consume, making them essential for funding other areas of the business. These products may not need as much investment but should be optimized for profitability.

Strategy: Maximize cash flow. Focus on efficiency and cost reduction while ensuring the product remains competitive.

3. Question Marks: The Daring Potential

Question Marks (or Problem Children) operate in high-growth markets but have low market shares. These products hold potential but require careful evaluation and strategic investment. The challenge is determining whether to invest heavily to improve their market position or to divest.

Strategy: Analyze market trends and competitive positioning. Decide whether to invest for growth or phase out the product if it doesn’t show promise.

4. Dogs: The Unwanted Relics

Dogs are products with low market share in a low-growth market. They are often seen as liabilities and may drain resources without providing significant returns. While they may have a loyal customer base, the potential for growth is limited.

Strategy: Evaluate the future of these products. Consider divesting, discontinuing, or repositioning them to minimize losses.

Why Use the BCG Matrix?

Simplifies Complex Decisions

In the ever-evolving business landscape, the BCG Matrix distills complex decisions into a straightforward visual framework. It helps companies quickly assess where to invest, where to cut back, and how to prioritize their product strategies.

Strategic Resource Allocation

With limited resources, knowing where to allocate your budget is crucial. The BCG Matrix provides a roadmap for investment decisions, ensuring that money and effort are directed toward the most promising areas.

Enhanced Communication

The visual nature of the BCG Matrix makes it easier for teams and stakeholders to understand and discuss strategic priorities. It fosters alignment across departments, facilitating a unified approach to business growth.

Limitations to Consider

While the BCG Matrix is a valuable tool, it’s not without its limitations. It oversimplifies complex market dynamics and may not account for factors like competitive intensity, customer preferences, or technological changes. Additionally, relying solely on market share and growth rates can lead to misguided decisions.

Conclusion: Navigating Your Business Landscape

The BCG Matrix is more than just a strategic tool; it’s a lens through which you can view your product portfolio and make informed decisions about the future. By categorizing your offerings into Stars, Cash Cows, Question Marks, and Dogs, you can better understand where to focus your efforts, invest your resources, and ultimately drive growth.

As you explore the intricacies of your business landscape, let the BCG Matrix guide your strategy. After all, in the world of business, knowledge is power—and with the right insights, you can unlock your company’s full potential!